We see paying your claims as a positive part of what we do. We take our responsibility seriously and we do all we can to ensure claiming is painless and that businesses keep on moving whatever happens to them. Last year we supported our customers when they needed us most, paying more than 98% of claims.

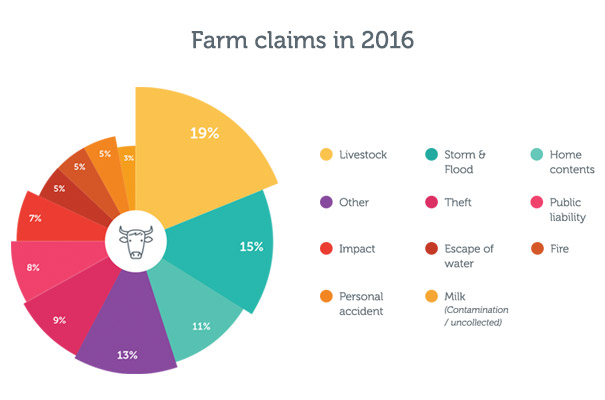

Claims against livestock continues to be the most common reason for customers to call on Rural. The majority of these claims are for fatal injury, with 45% occurring on own premises, and we’ve seen a 47% increase in these claims on last year. Not all insurers offer fatal injury on own premises. In many cases cover is offered for fatal injury away from own premises but with Rural you have the option to extend the cover to apply to incidences that occur on your farm where almost half of cases take place.

A stormy year

With numerous storms throughout the year including Storm Desmond, Eva and Frank it’s with no surprise that claims against storms and flood damage is one of our top 3 most common claim types. In comparison to last year we’ve seen farmers claiming for a higher number of weather related claims, particularly associated with damage to buildings and contents, but also surprisingly to livestock. The stormy weather has impacted livestock farmers with sheep being washed away by flood waters.

Low frequency but high cost

While only 5% of claims were related to fire in 2016, it accounts to over a third of the overall cost. Although the frequency of fire claims is low the implications can have a huge impact on farming businesses. Our claims manager Mark Jones says arguably the level of impact varies from farm to farm and can vary depending on the time of years. Fires can occur outside the summer months as farms have lots of combustible material from straw to kerosene which can ignite quickly causing severe damage.

With cover against fire you’re able claim against the damage caused but in some instances an incident can have implications on the day to day running of your farm. As such cover for business interruption is important as it enables you to continue trading through difficult times.

Business motor claims

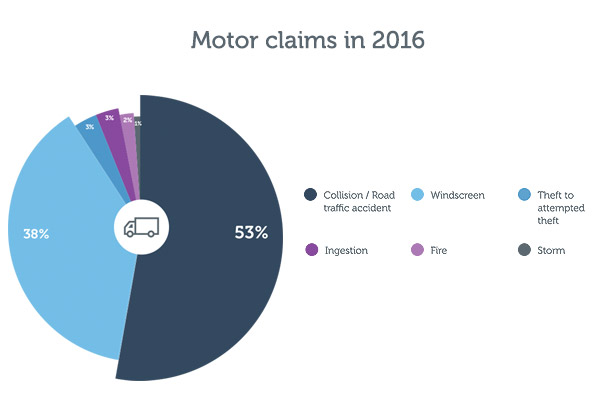

For our motor customers, collision and road traffic accidents accounted for over half of all claims. These figures are consistent with previous years showing no key changes in motor claims.

How to minimise the risk

We’re here should your clients need to make a claim but we also want to help reduce the risk of making a claim. There are a number of actions that can be taken to do this:

- Perform regular maintenance on your fences and boundaries to prevent livestock from straying

- Prune trees, undertake roof repairs and insulate/fix cracks in pipes to minimise storm damage

- Undertake regular maintenance and servicing on your vehicles and property

- Carry out risk assessments, train your employees and keep records

- Take extra care on country lanes, especially when overtaking or turning right

- Make regular checks on your property to make sure you’re not underinsured. Think about rebuild, demolition, clearance and architect fee costs.

- Make sure you’ve provided the correct business description and your activities are covered by your insurance. And do not arrange insurance for your child’s vehicle on your business insurance if they’re not actively involved in your business. These are two common areas of dispute or repudiation when it comes to claims.

We know that good, honest rural business owners will only claim when they need to. In the event of making a claim our experienced loss adjustors are always at the end of the phone to provide support and reassurance throughout the process. After all, caring about our customers’ businesses and livelihoods as if they were our own is a cornerstone of how we operate.

*Data based on Jan-Dec 2016 claims